Mightycause Foundation's Board of Directors

Pam Butler

Jack Quarles

Tom Matthews

FAQs

FAQs for Individuals

1. What is Mightycause Foundation?

Mightycause Foundation is an IRS recognized 501(c)(3) public charity that Mightycause Global Corporation (“Mightycause”) helped launch, but now operates as an independent Foundation while sharing Mightycause’s charitable vision and name.

2. Why did Mightycause launch Mightycause Foundation?

Mightycause, like Mightycause Foundation, is committed to making the grass roots support of charitable causes quick, easy, and efficient while satisfying all legal requirements and providing donors complete electronic records for personal accounting and tax purposes. To that end, Mightycause seeks to affiliate with charities that share its charitable and philanthropic goals. Among those charities is the Mightycause Foundation – the Foundation that Mightycause helped launch whose vision and capacity for donor advised funds would encompass the vast majority of U.S. based and IRS qualified public charities.

3. What is a donor advised fund?

Donor Advised Funds or “DAFs” are defined by a 2006 Act of Congress. They are the ideal legal vehicle to allow you as a donor to efficiently support your favorite public charities and rally your friends to do the same. In essence, DAFs are funds maintained by a public charity, such as Mightycause Foundation, which are owned and controlled by the charity, but with respect to which you as the donor (or someone you choose by passing to them a Giving Card) has advisory privileges as to the re-granting of those funds to other public charities.

4. What public charities may I choose for such regrants?

You may choose and advise Mightycause Foundation to make a regrant to virtually any US based public charity that is in good standing with the IRS. Mightycause Foundation has pre-approved in its data base the vast majority of U.S. based and IRS qualified public charities.

5. Does it cost me anything to donate on Mightycause?

No., donating on Mightycause is always without charge to you as the donor. Donors are always receipted for 100% of their contribution on Mightycause as a charitable contribution to Mightycause Foundation’s donor advised fund.

6. Suppose I want my gift regranted to a different charity?

Mightycause Foundation as an IRS approved public charity, operates one of the largest donor advised funds in the United States based on the number of public charities pre-approved for regrants. When you advise a regrant of your gift to one of the hundreds of thousands of pre-approved charities on Mightycause Foundation’s website, our charitable, tax exempt status assures you that regrants are handled on the most efficient cost-effective basis of any web-based entities handling charitable gift transactions. When your gift is regranted to your selected charity 93.1% of your original gift goes to that charity, with 6.9% + $0.30 per advisement applied to all the associated bank, credit card, and transaction fees.

7. Is my donation safe and secure?

Yes, we take data security very seriously at Mightycause Foundation. Mightycause.com is a secure, PCI-compliant site for donating to your favorite charities. We partner with U.S. Bank to securely process your donations, and use VeriSign (the industry leader in SSL certification) so that your personal information is vigorously protected. For more information, please read our Mightycause Foundation’s Privacy Policy.

Mightycause will not sell, rent, or trade your personal information to anyone outside of Mightycause. We also provide an anonymous donation option, if you prefer not to share your contact information with the recipient nonprofit.

8. Do I need to have an account on Mightycause.com to donate?

No, you do not need to sign up for an account on Mightycause.com in order to make a donation. However, we encourage you to create a personal account to collect all your tax-deduction receipts in one location, track Mightycause Foundation’s use of your donor-advised contributions, review the charities you have chosen as the grantees / recipients of your donor-advised contributions to Mightycause Foundation, and schedule future giving. Moreover, setting up an account lets you connect to and get updates from your favorite organizations. Sign up here.

9. Is my donation tax-deductible?

Yes, your donation is tax-deductible within the guidelines of U.S. law.

10. How much of my donation is receipted as a tax-deductible contribution and when?

100% of your online charitable gift is receipted as a charitable contribution.to Mightycause Foundation advised for regrant to your chosen charity. Email receipts are sent immediately by Mightycause Foundation upon successful processing of your donation. To claim a donation as a deduction on your U.S. taxes, please retain your email donation receipt as an official record.

11. If I misplace my email receipt, how may I get a duplicate?

There are two easy ways to obtain a duplicate receipt. You can also view your giving history and receipts any time by logging into your Mightycause account, or request a duplicate receipt by emailing donations@mightycausefoundation.org – please include your full name, date of donation, amount of donation, and name of your designated nonprofit.

12. Why does my tax receipt reference the Mightycause Foundation?

Your contribution is made to Mightycause Foundation, a registered 501(c)(3) public charity that operates a donor advised fund. It is Mightycause Foundation’s normal practice to regrant 93.1% less $0.30 of a donor-advised contribution to the qualifying IRS recognized 501(c)(3) organization advised by the donor, and to retain 6.9% + $0.30 per advisement for Mightycause Foundation’s expenses (including credit card transaction costs). A regrant to the advised organization is generally made on the 10th of the month following receipt of the advised contribution. That is why your credit card statement will list Mightycause Foundation, not the charity advised by you for regrant.

13. How may I track and confirm the regrant of my contribution to the charity I have chosen?

By opening an account on Mightycause.com, you will have 24/7 access to your contribution history going back to 2008, along with dates and amounts of all advised regrants to your chosen charities.

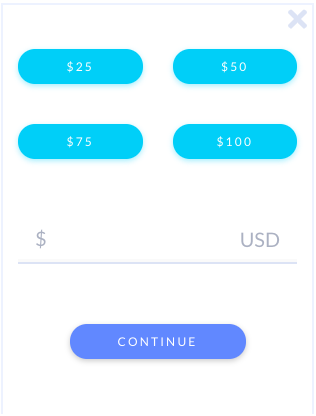

14. Is there a minimum donation amount?

Yes, your donation must be at least $10 to be processed through Mightycause Foundation.

15. How does Mightycause Foundation compile its list of charities approved for regrant?

Mightycause Foundation’s database of 501(c)(3) organizations is derived from the current Exempt Organizations: IRS Master File, also known as IRS Publication 78. This list may be accessed by visiting Mightycause.com.

16. Does Mightycause Foundation’s list of approved public charities for regrant include all eligible charities.

Not quite, but almost. Mightycause Foundation’s list of charities approved for regrant is growing to be the most comprehensive list of public charities eligible for regrants.

17. Which charities are excluded from Mightycause Foundation’s list of eligible charities?

As required by Federal law, Mightycause Foundation’s list of public charities eligible for regrants excludes from the IRS Master File all private non-operating foundations and certain supporting organizations.

18. Are there public charities that I may want to give to that are eligible but not currently on Mightycause Foundation’s list?

Yes, and this is where you can be a big help in making the Mightycause Foundation list of approved charities the most comprehensive available. First, the IRS Master File is not perfect, and some organizations are de-listed or not listed by mistake. Second, the IRS Master File is not complete. There are at least 3 categories of public charities that are not included in the IRS Master file among the 1.3M 501(c)(3) charities. The IRS Master File does not include most churches (only 60,000 of the 360,000 churches, and other houses of worship are listed) or small charities (estimated at another several hundred thousand charities), because they are exempt from having to file with the IRS to operate as tax exempt entities. A third category of eligible public charities not listed in the IRS Master File are the affiliates of a central organization, like most of the local chapters of the Boy Scouts or Girl Scouts or YMCA. All three of these categories of public charities are eligible to receive regrants from Mightycause Foundation, and should be on our lists. But the only way we will know about these many worthy charities is if you tell us.

19. So if I can’t find the organization I am looking for in your list of charities that I wish to benefit from my donor-advised contribution, what should I do?

If you represent an organization that is a registered 501(c)(3) that does not appear in the Mightycause Foundation database, please send us the organization’s current letter of determination from the IRS via email (info@MightycauseFoundation.org).

If you represent a local affiliate of an central organization that holds a group exemption, please send us via email (info@MightycauseFoundation.org) the following two items:

- the central organization’s current letter of determination from the IRS, and

- its most recent filing with the IRS listing your local organization as covered by its group exemption.

If you represent an organization that is a religious or faith-based organization not required to file with the IRS, please send us via email info@MightycauseFoundation.org) the following three items:

- an official denominational listing clearly identifying this church or house of worship e.g. state letter for churches, Lutheran Directory, etc.

- EIN Issuance Letter from the IRS, and

- request on official letterhead from the senior pastor or other head of the organization requesting inclusion in the Mightycause Foundation master list, confirming that the organization is duly constituted as a church or other religious organization, year and jurisdiction of creation, and has been in continuous operation as such for at least the last ten years. Please also include your contact information: name, title, phone #, email address, and organization website.

If you represent an small organization that has annual gross receipts of less than $5,000 and is organized as a nonprofit charity, but does not appear in the Mightycause Foundation database, please send us via email (info@MightycauseFoundation.org) the following three items:

- a request on official letterhead from the head of the organization requesting inclusion in the Mightycause Foundation master list, confirming that the organization is duly constituted as a nonprofit, charitable organization, year and jurisdiction of creation, and has been in continuous operation as such for at least the last ten years;

- a copy of the entity’s organizational documents (normally this would be the Articles and Bylaws);

- an EIN Issuance Letter from the IRS, if there is one; and 3.) a statement on official letterhead from the head of another community organization affirming the requesting charity’s bona fides and good standing in the community.

20. Can I specify how the nonprofit that I have listed as the preferred beneficiary of my donor-advised contribution may use those funds?

Yes, to a degree. You may specify how you’d like those funds to be used by the nonprofit by completing the “Requested Use” field on the donation form (located on Mightycause.com). We will provide this information to the organization exactly as you have given it to us, but we cannot guarantee that the nonprofit will honor your request. You may also contact the nonprofit directly to communicate your preferences.

21. Can I create a recurring donation?

Yes, you can set-up regular donor-advised contributions on a weekly, monthly, annual, or other periodic basis. Simply choose your frequency in the drop-down menu on the donation form (the default is to make a one-time donation). Please note that you will be required to create a Mightycause.com user account in order to make recurring donations.

22. How do I cancel my recurring donation?

You can cancel your recurring donation at any time by logging into Mightycause.com, clicking on your name located at the top right of the screen, then “My Donations” and “Scheduled Donations.” Click the “Cancel” button below the appropriate recurring donation listing.

23. How and when does my donor-advised contribution get distributed to my favorite nonprofit?

Mightycause Foundation batches its grants to nonprofits each month and makes a payment on or around the 10th of the following month. For example, if you made a donation on January 20 through Mightycause, the qualified nonprofit grantee would receive the funds on or around February 10.

1. How do I create a Mightycause.com account?

You can create a user account for free by completing simple sign up form on Mightycause.com, our partner portal.

2. I created an account but don’t remember my password. How can I retrieve a new one?

Please use the password reset link. Be sure to enter the email address you used to create your Mightycause.com account. Please note that the password reset email expires after 1 hour, so please check your spam folder if the email does not appear in your inbox.

3. How do I edit my personal information?

You can view or edit your personal information by logging-in to your Mightycause.com account, clicking on your name located at the top right of the screen, then clicking the tab marked “My Profile.” You can select the tab “Account Settings” to update your e-mail address or change your password.

4. How do I view my giving history through Mightycause?

To view your donation history, first login to your Mightycause.com account. Click on your name located at the top right of the screen, and then click on “My Donations.” Here you can also obtain a duplicate copy of tax receipts.

5. Is my personal information safe?

Yes, we take privacy and data security very seriously. MightycauseFoundation.org and Mightycause.com are secure, PCI-compliant sites for donating to your favorite charities. Since Mightycause launched in late 2008, and Mightycause Foundation launched in late 2010, we have facilitated more than $500 million in donations to more than 30,000 nonprofits. We partner with leading merchant processors to securely process your donations, and we use industry standard SSL certification so that your personal information is vigorously protected.

Mightycause Foundation will not sell, rent, or trade your personal information to anyone outside of Mightycause or Mightycause Foundation. We also provide an anonymous donation option, if you prefer not to share your contact information with the recipient nonprofit. For more details, please read our Privacy Policy.

1. How do I create a Fundraising Page to support a nonprofit?

You can create a Fundraising Page for free by completing the simple form on Mightycause.com.

Alternatively, you can visit the Organization Page of any nonprofit listed on Mightycause.com and click “Fundraise” to start the page creation process.

Please note that in order to create a Fundraising Page you will be prompted to sign into your Mightycause.com user account, or create one if you don’t already have an account.

2. Does it cost anything to have a Fundraising Page on Mightycause.com?

No, there are no set-up or subscription fees associated with a Fundraising Page, and it only takes a few minutes to get started. Here are some helpful tips.

3. What tools can I use to get the word out?

Click the “Promote” link on your Mightycause.com page to use the promotion tools, which include integration with your email, Facebook, and Twitter accounts.

Mightycause.com also provides the code for a “Donate Now” button if you would like to add this to a personal website or blog. Even better – embed the “Donate Anywhere” widget onto your blog or website to enable friends and family to give to your fundraiser directly on your own website. You can get the code for this by selecting the box on the right side of your fundraising page on Mightycause.com labeled “Donate Anywhere.”

4. How can I keep track of donations through my Fundraising Page?

You will receive an email notification from Mightycause Foundation when a donation is made to your page. You can also visit your page and click on the “Donations” link to view a Donations report, which can be downloaded as a .csv file.

5. Do I need to handle any of the funds to ensure it gets to the nonprofit that I have selected as the preferred grantee/recipient of my donor-advised contribution?

No, we will handle the credit card processing, receipting, and disbursement for you! We do encourage you to thank donors as they make contributions through your Fundraising Page.

FAQs for Nonprofits

1. Suppose our organization is a bona fide public charity, but not currently on Mightycause Foundation’s list, why is that?

Yes, and this is where you can be a big help in making the Mightycause Foundation list of approved charities the most comprehensive available. First, the IRS Master File is not perfect, and some organizations are de-listed or not listed by mistake. Second, the IRS Master File is not complete. There are at least 3 categories of public charities that are not included in the IRS Master file among the 1.3M 501(c)(3) charities. The IRS Master File does not include most churches (only 60,000 of the 360,000 churches, and other houses of worship are listed) or small charities (estimated at another several hundred thousand charities), because they are exempt from having to file with the IRS to operate as tax exempt entities. A third category of eligible public charities not listed in the IRS Master File are the affiliates of a central organization, like most of the local chapters of the Boy Scouts or Girl Scouts or YMCA. All three of these categories of public charities are eligible to receive regrants from Mightycause Foundation, and should be on our lists. But the only way we will know about these many worthy charities is if you tell us.

2. My nonprofit is not on your site – how does it get listed?

The database of nonprofits on our site includes 501(c)(3) organizations listed in the IRS Master File, excluding private non-operating foundations. If your organization is a registered 501(c)(3) and not in our database, please send us your letter of determination from the IRS via email (info@MightycauseFoundation.org).

If you represent an organization that is a registered 501(c)(3) that does not appear in the Mightycause Foundation database, please send us the organization’s current letter of determination from the IRS via email(info@MightycauseFoundation.org).

If you represent a local affiliate of an central organization that holds a group exemption, please send us via email (info@MightycauseFoundation.org) the following two items:

- the central organization’s current letter of determination from the IRS, and

- its most recent filing with the IRS listing your local organization as covered by its group exemption.

If you represent an organization that is a religious or faith-based organization not required to file with the IRS, please send us via email (info@MightycauseFoundation.org) the following three items:

- an official denominational listing clearly identifying this church or house of worship e.g. state letter for churches, Lutheran Directory, etc.

- EIN Issuance Letter from the IRS, and

- request on official letterhead from the senior pastor or other head of the organization requesting inclusion in the Mightycause Foundation master list, confirming that the organization is duly constituted as a church or other religious organization, year and jurisdiction of creation, and has been in continuous operation as such for at least the last ten years. Please also include your contact information: name, title, phone #, email address, and organization website.

If you represent an small organization that has annual gross receipts of less than $5,000 and is organized as a nonprofit charity, but does not appear in the Mightycause Foundation database, please send us via email (info@MightycauseFoundation.org) the following three items:

- a request on official letterhead from the head of the organization requesting inclusion in the Mightycause Foundation master list, confirming that the organization is duly constituted as a nonprofit, charitable organization, year and jurisdiction of creation, and has been in continuous operation as such for at least the last ten years;

- a copy of the entity’s organizational documents (normally this would be the Articles and Bylaws);

- an EIN Issuance Letter from the IRS, if there is one; and 3.) a statement on official letterhead from the head of another community organization affirming the requesting charity’s bona fides and good standing in the community.

3. What if I want the nonprofit I represent removed from your database?

Contact us via email (info@MightycauseFoundation.org) and we will immediately remove you from our list.

4. The nonprofit I represent is not registered in the United States – can it still be listed on Mightycause?

If the nonprofit you represent is registered outside the United States, it may still be listed on Mightycause if a US-registered 501(c)(3) organization agrees to serve as its fiscal sponsor. For more help with setting up a fiscal sponsorship, please email info@MightycauseFoundation.org.

For more information about fiscal sponsorship, please read this article.

1. How can I update the information on the page of the nonprofit I represent?

If you are an authorized representative of a nonprofit, you can edit content on the organization’s page by applying for Administrative Access via the Mightycause.com online form. Please note that you will first need to sign up on Mightycause.com for an individual account in order to obtain Administrative Access.

Once approved, you will receive an email from do-not-reply@mightycauseFoundation.org, notifying you of your administrative privileges. When you login to your Mightycause.com account, you will then see a “My nonprofit” link at the top menu bar where you can access our Admin Tools to edit the organization’s page.

2. How can I update an organization’s address as it appears on Mightycause.com?

If the nonprofit’s address has changed, please provide the following via email (info@MightycauseFoundation.org):

- Name and EIN of organization

- Your name and title

- Organization’s website reflecting the correct address, and

- Official documentation of the change in address. (Acceptable forms of documentation include: utility bill, bank statement, confirmation from IRS of address change, or Certificate of Change of Principal Office)

Once you have submitted the above to Mightycause Foundation, we can update the address as it appears on the organization’s page. Please note that any grant checks that are sent to an organization will be only sent to the address we have on file for that organization.

3. Can an organization have more than one administrator?

Yes, an organization can have multiple administrators, although it will be up to the organization to internally coordinate page edits, Project Page creation, and management of donation reports. Each administrator must be an authorized representative of the organization, and complete the Mightycause.com online form.

4. I am the local chapter representative of a national organization. What should I do if our local chapter is not separately listed in the IRS Master File or in Mightycause.com?

If your local chapter is not listed but comes under the group exemption of a national organization, we encourage you to create a Fundraising Page on behalf of the national organization.In the “Title” field, you can specify the name of your local chapter so that funds raised through the fundraising page will be designated for your local organization. The internal accounting staff of the national organization can then distribute those funds to your local chapter – please coordinate directly with your national organization. Alternatively, if you represent a local affiliate of an central organization that holds a group exemption, you may send us via email (info@MightycauseFoundation.org) the following two items:

- the central organization’s current letter of determination from the IRS, and

- its most recent filing with the IRS listing your local organization as covered by its group exemption.

5. Can I use Project Pages to sell event tickets or auction items?

No, Mightycause does not support the selling of tickets or any other good or service. The donor of any online donation cannot receive, nor be promised to receive, any valuable goods or services as a result of such a donation.

1. Are there any setup or subscription fees for a nonprofit to receive grants through Mightycause Foundation donor advised fund?

No. Unlike many other websites, there are no sign up or subscription fees on Mightycause. Mightycause Foundation retains 4% for platform costs plus 2.9% and $0.30 cents per advisement for credit card processing costs.

2. How and when will a nonprofit receive funds that are donated through Mightycause Foundation?

Mightycause Foundation makes grants to advised charities each month on or around the 10th of the following month. For example, if a donation was made on January 20 through Mightycause, Foundation, the approved nonprofit would receive the funds on or around February 10.

Grant checks are mailed to the organization’s address on file with Mightycause Foundation unless the organization has set up an electronic funds transfer (EFT). For more information about grants, please see How Donations Work. If you have questions about disbursements, please contact info@MightycauseFoundation.org.

3. How can a nonprofit set up an Electronic Funds Transfer (EFT)?

If a nonprofit is interested in receiving its monthly disbursement via EFT, more information can be found here.

4. How can I view a grant report for the nonprofit I represent?

To view a grant report and view donor contact information, log into your Mightycause.com account and click on ‘My nonprofit.’ In the Admin Tools, choose ‘Donations,’ where you can view a report online or download it as a .csv file.

Mightycause.com also provides an online Disbursement report so that you can cross-reference transactions included in your monthly disbursement with your Donations report. The Disbursement report is another link in the Admin Tools that can be accessed by clicking on ‘My nonprofit.’

5. Does a nonprofit that receives grants from Mightycause Foundation need to issue tax receipts to its donors for Mightycause donations?

No, donations made through Mightycause Foundation will receive an email receipt from Mightycause Foundation. However, Mightycause Foundation does encourage nonprofits to send a thank you note to Mightycause Foundation donors letting them know how awesome they are.

6. Where do donors’ tax receipts come from?

Tax-deductible receipts are issued by Mightycause Foundation via email. Our platform service provider, Mightycause.com’s Customer Support Team can issue duplicate receipts for all donations made through Mightycause Foundation. Donors should email info@MightycauseFoundation.org with their full name, date of donation, designated nonprofit, and donation amount.

7. Why do the donation receipts reference the Mightycause Foundation?

The Mightycause Foundation is a registered 501(c)(3) public charity that operates a donor advised fund. It is Mightycause Foundation’s normal practice to regrant 93.1% less $0.30 of a donor-advised contribution to the qualifying IRS recognized 501(c)(3) organization advised by the donor, and to retain 4% for platform costs plus 2.9% and $0.30 cents per advisement for credit card processing costs. A regrant to the advised organization is generally made on the 10th of the month following receipt of the advised contribution. Mightycause Foundation issues a tax receipt to donors (contributions are tax-deductible for U.S. taxpayers to the full extent permitted by law).

Filings and Financials

This section provides valuable information on the finance and operations of the Mightycause Charitable Foundation. For more information contact us at legal@mightycausefoundation.org.

PCI Compliance

Mightycause Foundation is Level 2 & 3 Payment Card Industry (PCI) compliant. For more information on PCI Compliance, please visit visit the Payment Card Industry Security Standards Council website.

MightycauseDonations.org on your Statement

The Mightycause Foundation provides a secure donation processing infrastructure to you, the donor, so that you can support your favorite nonprofit through our Donor Advised Fund via our easy and secure portal hosted by our partner, Mightycause.com. Here are a few ways you might have used our services.

Please email support@mightycause.com if you need assistance obtaining a copy of a receipt or to find out which nonprofit you supported via Mightycause!

Mightycause Donation Widget

The widget makes it easy for nonprofits and fans of nonprofits to accept donations on their own web sites.

Partners and Giving Days

Mightycause Foundation is proud to work with Community Foundations, State Associations, and nonprofits around the country to host giving day event and giving portals. Some of our partners include:

- Minnesota’s GiveMN – GiveMN

- Tampa Bay's Give Day Tampa Bay – Tampa Bay Community Foundation

- Giving Day for Apes – The Arcus Foundation

- And many others!

Mightycause

![]() Mightycause is a for profit entity that provides innovative web-based products and services that help people and organizations (nonprofits, foundations and corporations) achieve their philanthropic goals. Mightycause Foundation has partnered with Mightycause and other organizations to provide cost-effective processing and disbursement solutions.

Mightycause is a for profit entity that provides innovative web-based products and services that help people and organizations (nonprofits, foundations and corporations) achieve their philanthropic goals. Mightycause Foundation has partnered with Mightycause and other organizations to provide cost-effective processing and disbursement solutions.